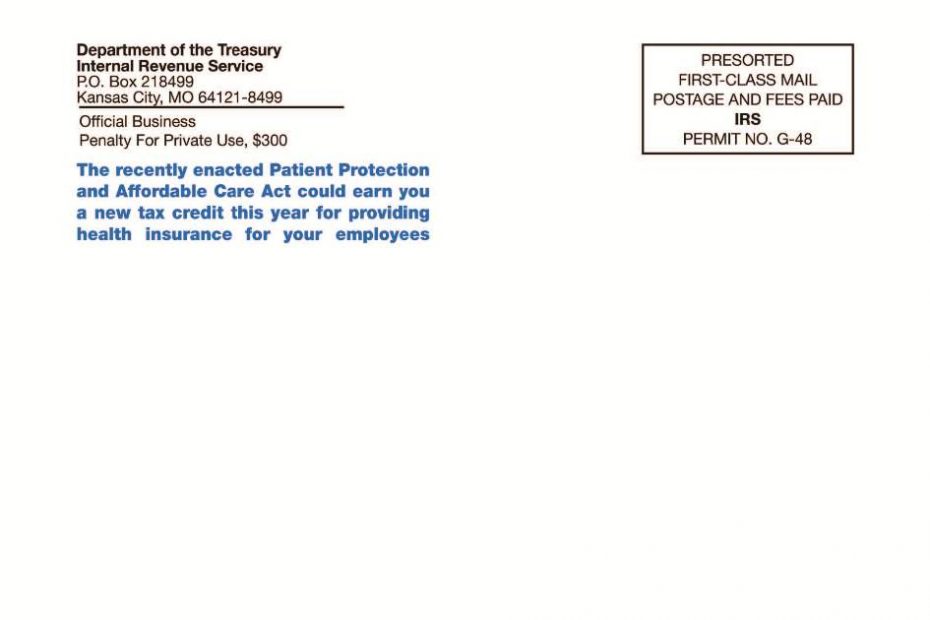

Tax aspects of health care law

The new health care law includes sweeping changes for both employers and individuals. Following is a brief summary of several key tax-related provisions. Coverage for individuals: After 2013, any individual not eligible for Medicare or… Read More »Tax aspects of health care law